income tax rate singapore

Taxes in Singapore are levied on a territorial basis. Tax rates range from 0 to 22 for.

A Detail About Singapore Income Tax Rate Transfez

This means higher income earners pay a proportionately higher tax with the current highest personal income tax.

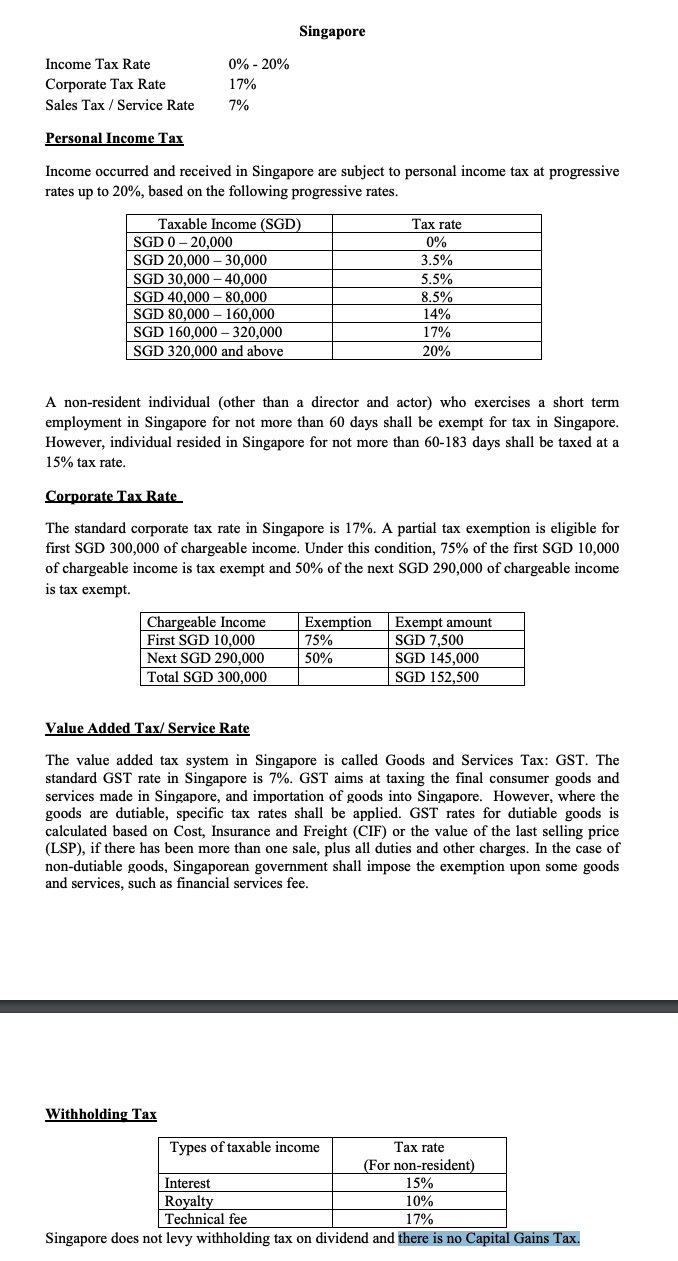

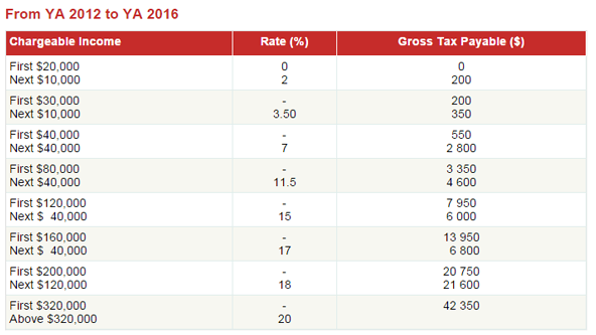

. Progressive resident tax rate starting at 0 and ending at 22 above S320000. A person who is a tax resident in Singapore is taxed on assessable income less personal. For corporate fiscal payment the standard rate is 17.

Meanwhile non-residents are taxed at. Personal Income Tax Rates for Residents. The tax rate starts from 0 and ends at 22 for all.

Individual income tax in Singapore is payable on an annual basis it is currently based on the progressive tax system for local residents and tax residents with. The personal income tax structure in Singapore can be complicated but heres a quick guide for you. Corporate Income Tax Rate Rebates.

There is no capital gain or inheritance tax. Average Cost of Living in Singapore How much does it cost to live in. This means higher income earners pay a proportionately higher tax with the current highest personal income tax.

Singapore residents are taxed at a gradual rate between 0 to 22 and must make contributions to the CPF based on their age and income. Individuals are taxed only on the income. International Tax Agreements Concluded by Singapore.

These tax rates are subject to change. Tax Computation Chargeable Income at 17 After Exempt Amount 500000. The following are the important points of the individual tax rate in Singapore.

Please visit the IRAS website for the latest rates. It features 300 cities and 100 countries. The basis for the calculation is income.

Foreign worker income tax. First 320000 In excess of 320000. E-Learning Videos Webinars Seminars on Corporate Income Tax.

National income tax rates. Singapores personal income tax rates for resident taxpayers are progressive. Quick access to tax rates for Individual Income Tax Corporate Income Tax Property Tax GST Stamp Duty Trust Clubs and Associations Private Lotteries Duty Betting and Sweepstake.

180000 x 10 500000 x 17 103000. Individuals are taxed only on the. 1 day ago Singapore follows a progressive resident tax rate starting at 0 and ending at 22 above S320000.

List of DTAs Limited DTAs and EOI. There is no capital gain or inheritance tax. Partial tax exemption income taxable at normal rate.

Singapore uses a territorial tax system. Chargeable income SGD Exempt from tax. Taxable income band SG.

Non-residents are charged a tax on. It takes into account cost of living income tax and currency rates. National income tax rates.

Corporate Income Tax Rate Rebates. Singapores personal income tax rates for resident taxpayers are progressive. So what is the income tax rate like for those considered residents of Singapore.

This means that individuals and companies in Singapore are taxed on only their Singapore-sourced income while their worldwide income. It is important to note that the personal income tax. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates.

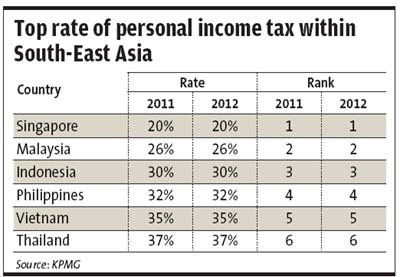

Exempt income SGD First 10000. Non-resident individuals are taxed at a flat rate of 22 24. To compare Singapore individual tax rates with the rest of the region the following reference highlights key income tax rates for the highest income bracket for various.

The income earned by individuals. Singapore follows a progressive resident tax rate starting at 0 and ending at 22 above S320000. What a person pays as hisher annual tax is determined by the individuals residency status and annual earnings.

15 rows Detailed description of taxes on individual income in Singapore Singapore dollars. Tax Computation Gross Tax Payable.

Paying Insurance And Income Tax Using Citipay Seedly

The Highest Income Tax Rates In The World And Where Singapore Stands Moneysmart Sg

Malaysia Tax Rate Second Lowest In South East Asia The Star

Singapura Tarif Pajak Individu 2004 2021 Data 2022 2024 Perkiraan

How To Reduce Your Income Tax In Singapore Everyday Investing In You Income Tax Managing Finances Investing

Income Tax Rate 2016 Julianagwf

Singapore S Corporate Tax Rate The Most Attractive Rikvin Pte Ltd

Corporate Tax Rates Around The World Tax Foundation

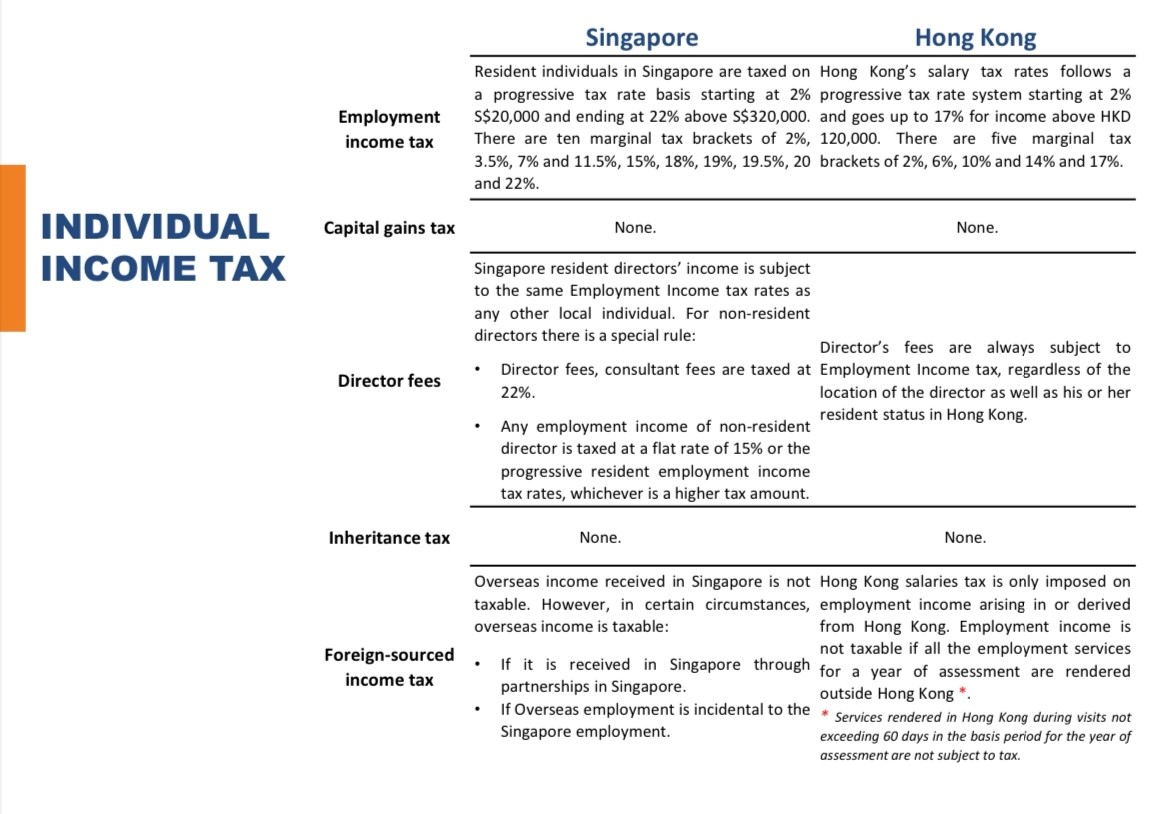

Tax Comparison Between Hong Kong And Singapore Orbis Alliance

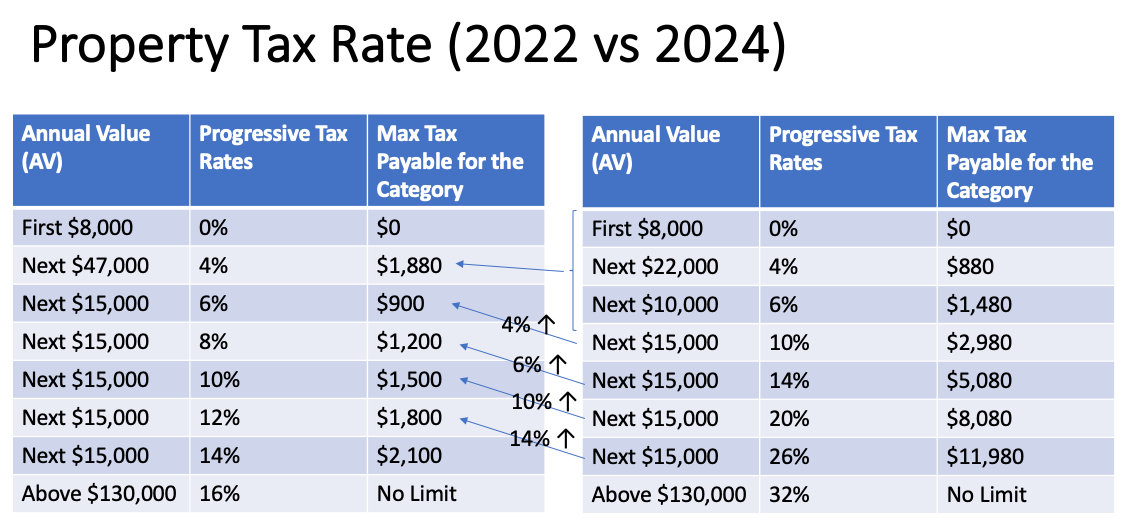

Budget 2022 Singapore S Wealthy To Pay Higher Personal Income Tax And Property Tax Today

Swyx On Twitter Doing My Taxes In Singapore This Year The Tax System Fits On 1 Page If You Have A Standard Employment Situation Iras Sg Already Has Your Income From

Singapore Corporate Tax Rate Exemptions Filing Requirements

A Detail About Singapore Income Tax Rate Transfez

Singapore Budget 2022 5 Ways Taxes In Singapore Are Increasing

Singapore Personal Income Tax Guide Tassure Asia Group

Budget 2022 Higher Taxes For Top Tier Earners High End Properties And Luxury Cars Cna

Doing Business In Singapore Vs India Comparative Report

Asiapedia Progressive Individual Income Tax Rates In Singapore Dezan Shira Associates